Oklahoma woman pleads guilty to embezzling over $280,000 from dental office

THIS BLOG IS OUT-OF-DATE!

This blog was moved in 2019 and renamed "Dental FraudBusters"

JUNE 7, 2018, BY DALLAS FRANKLIN (KFOR)

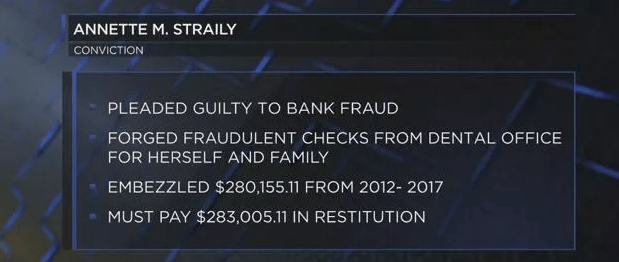

OKLAHOMA CITY – An Oklahoma woman has pleaded guilty to embezzling more than $280,000 from a dental office.

Officials with the United States Department of Justice say Annette M. Straily, of Comanche, pleaded guilty to bank fraud and singing a false federal income tax return in connection with a $283,000 embezzlement scheme from a Duncan dental office.

Officials say on May 24, Straily was charged with one count of bank fraud and one count of filing a false federal income tax return.

From April 2012 until June 2017, Straily worked as the office manager of a dental office in Duncan, Oklahoma.

As part of her job, she prepared checks, paid invoices, managed the accounting system, and maintained the petty cash fund.

Yesterday, officials say Straily pleaded guilty to preparing an unauthorized office check, in the amount of $1,266.80, made payable to herself in February 2017.

Straily reportedly admitted that she forged the signature on the dental office’s check and later presented that check for payment against the dental office’s bank account at a local bank.

As part of her plea, Straily further admitted that she embezzled funds from her former employer from around April 2012 through June 2017.

Straily stipulated in a plea agreement that the total restitution due to the Duncan dental office from the embezzlement scheme is $283,005.11.

In addition to pleading guilty to bank fraud, Straily pleaded guilty to signing a false tax return.

She admitted that on April 13, 2016, she signed a personal federal tax return for the 2015 calendar year that she knew was false because it reported only $49,127 in total income.

At yesterday’s plea hearing, Straily admitted that she omitted on the 2015 return more than $100,000 of embezzled income for that year from the dental office.

As part of her plea agreement, Straily agreed that she owes $54,286 in restitution to the Internal Revenue Service for the tax loss.

The tax fraud charges are encouraging.

I’ve observed in recent years an increase from in my own embezzlement investigations, and those covered in the news media, that more embezzlers are being charged with tax fraud. (filing a false income tax return and FAILING to claim the income gained by their crime. ) Part of my standard workflow is to advise my clients to report losses to the tax authorities – IRS (US) or CRA (Canada)

William Hiltz BSc MBA CET

At sentencing, Straily faces up to 30 years in prison on the bank fraud count, plus five years of supervised release, and a $1,000,000 fine.

Straily also faces up to three years in prison on the tax count, in addition to one year of supervised release, and a $250,000 fine.

Straily will be sentenced in approximately 90 days, officials say.

Source: Oklahoma woman pleads guilty to embezzling more than $280,000 from dental office | KFOR.com